Overview

Temenos Digital for Salesforce combines Salesforce Financial Service Cloud – the world best CRM platform with Temenos Digital - the industry leading digital banking platform.

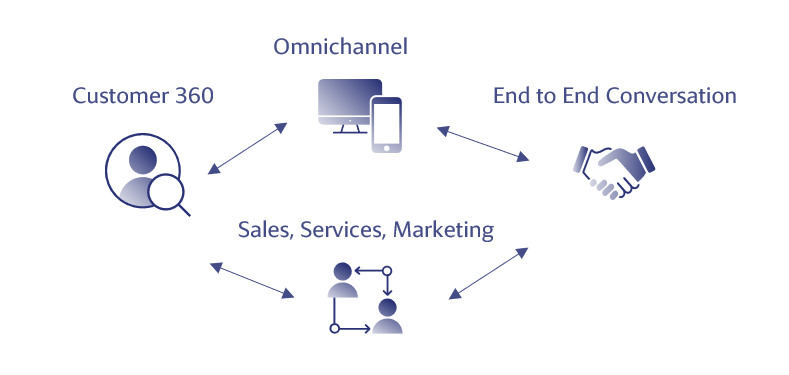

Temenos Digital for Salesforce is a fully digital, end-to-end solution that employers bank officers with a unified, actionable, and comprehensive customer 360º view across channels to strengthen customer relationships, sell financial products and service customer. It is a new channel for high-touch employees that brings together the relational capabilities Salesforce has with the transactional data from the core system so that the customer-facing bank’s employees can provide best-in-class advice considering the full picture.

The key benefits the bank can have:

- Improved 360 Customer View.

- Supercharged Employees: They have all the information in hand in a single application and can perform all the operations they want.

- Truly Omni channel presence: Out of the Box integration of Digital and Physical channels. Enables branch users, agents and relationship managers to support customer applications journeys or initiate application processes on behalf of the customer using the same platform.

- Streamlined Business Processes/Accelerator Approach: A single application will perform everything for you. Once the product matures enough, application will be enough for the bank employees to provide all kinds of assistance to the customers of the bank.

- Reduced time to value (prebuilt UI, prebuilt Integration).

- Lower implementation cost.

- Reduced complexity, lower risk (lightning components).

- Best practices embedded.

- Continuous innovation.

- End-to-End conversion Funnel (from leads to contracts): This begins with the start of the lead, nurturing the lead, getting referrals (list of names and phone numbers), contacting them and making them aware about the offerings. The bank employee should be able to view all the information about the customers, types of accounts the customers have in the bank, holdings and balances the customers have in the bank with each account.

- Grow revenue.

- Increased transparency.

- Reduced drop off ratios through re-targeting, improved sales processes.

- One Platform having all capabilities at your fingertips.

- Relational and transactional (advisory and loyalty focus).

- Amazing customer and employee experience (NPS).

- Sales, Servicing, Marketing, and Origination brought together.

- Supercharged relationship managers with actionable insights (employee productivity).

- Seamless business processes (Onboarding and Origination).

In this topic